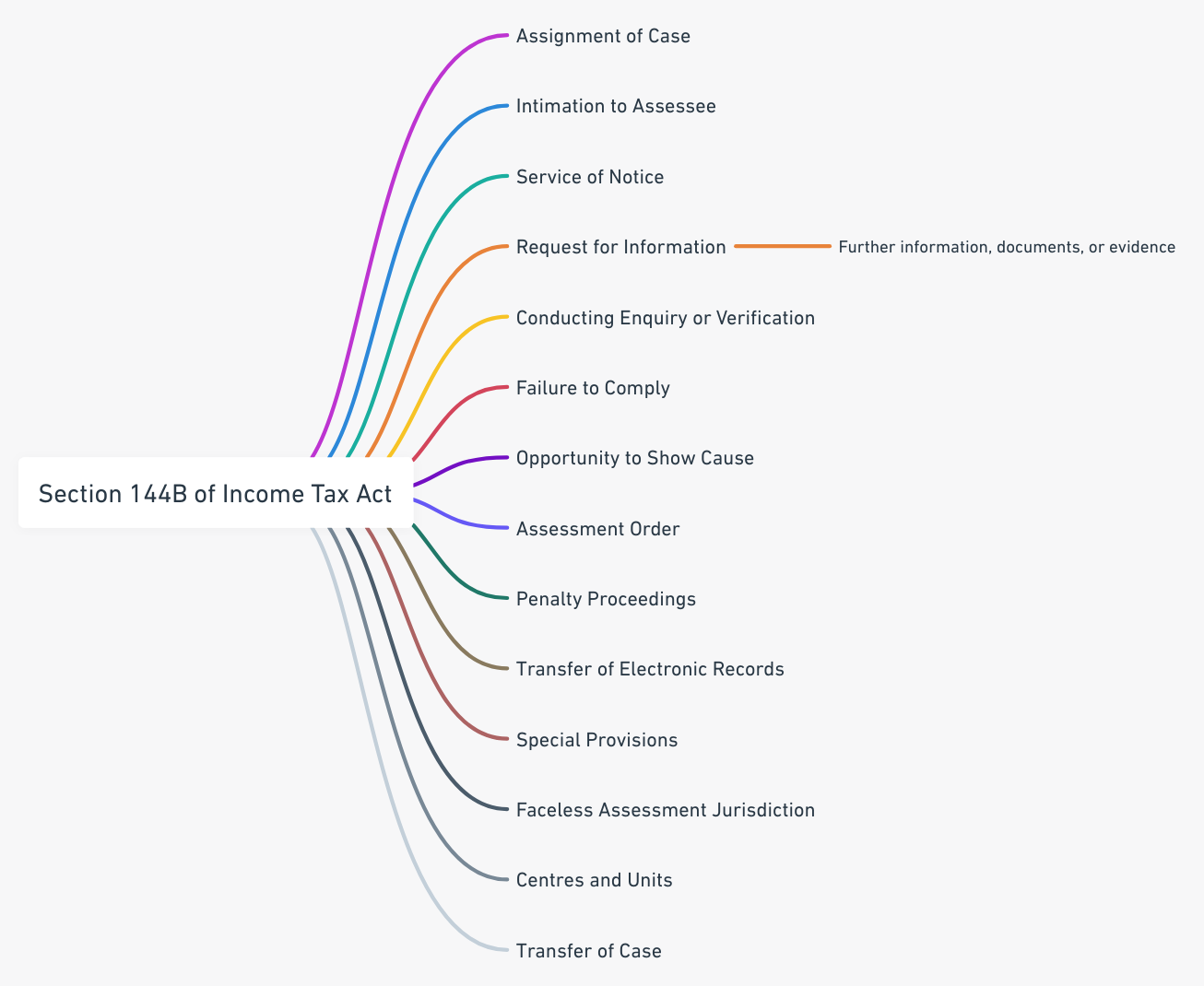

Faceless Assessment Procedure under Section 144B of Income Tax Act – Part 2

Introduction We have delved into the Introduction to Faceless Assessment Procedure under Section 144B, exploring provisions related to automated allocation of cases, intimation a

Faceless Assessment under Section 144B of Income Tax Act: A Comprehensive Legal Framework and Implementation Analysis

Introduction The Indian taxation landscape witnessed a revolutionary transformation with the introduction of the Faceless Assessment Scheme under Section 144B of the Income Tax Act

Introduction to Faceless Assessment

Introduction Faceless Assessment represents a significant shift in the way tax assessments are conducted. It aims to eliminate human interaction in the assessment proceedings, ther

Whatsapp

Whatsapp