Cross-Border Taxation and India’s GAAR: Conflict or Coherence?

Introduction In an era of globalized business operations and sophisticated cross-border tax planning, nations worldwide have been compelled to develop robust anti-avoidance framewo

TDS Defaults: Legal Remedies and Penal Consequences for Companies

Introduction Tax Deducted at Source (TDS) forms a critical component of India’s direct tax collection mechanism, designed to ensure the timely and consistent flow of revenue

Faceless Assessment Scheme in India: Constitutional Challenges

Introduction The introduction of the Faceless Assessment Scheme in India represents one of the most significant structural reforms to the country’s tax administration system

Unveiling the Shadow Economy: Understanding Undisclosed Sources of Income and Its Tax Implications

Introduction: Undisclosed Sources of Income in the Indian Tax System In the complex world of taxation, one of the most challenging aspects for tax authorities is dealing with undis

An In-depth Analysis of Section 115BAC: Understanding the Optional Scheme vs. Default Scheme of Taxation

Introduction: The landscape of taxation in India has witnessed significant changes over the years, with amendments and new provisions being introduced to streamline the system and

Addition Cannot Be Deleted Merely for Mentioning Section 68 Instead of 69: A Legal Analysis of ITAT’s Approach to Unexplained Cash Credits

A summary of the case law and its implications for income tax assessments Introduction The Income Tax Appellate Tribunal (ITAT) continues to play a crucial role in shaping the juri

Dispute Resolution Panel under Section 144C of the Income Tax Act

Introduction As previously discussed, Section 144B outlines the procedure for faceless assessment, Section 144C deals with the Dispute Resolution Panel. Together, they provide a co

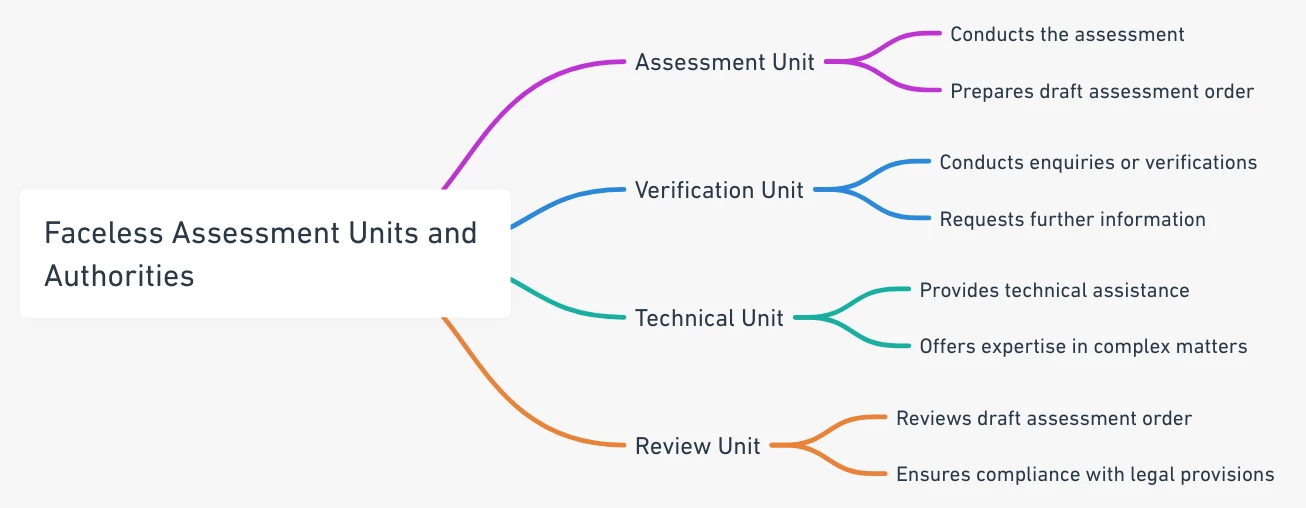

Faceless Assessment Procedure under Section 144B of Income Tax Act: Legal Framework and Operational Units

Introduction The introduction of Section 144B in the Income Tax Act, 1961, through the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020, represent

Faceless Assessment Procedure under Section 144B of Income Tax Act- Part 4

Introduction We have discussed the Introduction to Faceless Assessment, Part 1 of the series discussed provisions related to assignment and communication, Part 2 talked about enqui

Faceless Assessment Procedure under Section 144B of Income Tax Act – Part 3

Introduction Until now, we have discussed the Introduction of Faceless Assessment, assignment of cases and communication of response in Part 1, & request for information and do

Whatsapp

Whatsapp