Addition Cannot Be Deleted Merely for Mentioning Section 68 Instead of 69: A Legal Analysis of ITAT’s Approach to Unexplained Cash Credits

A summary of the case law and its implications for income tax assessments Introduction The Income Tax Appellate Tribunal (ITAT) continues to play a crucial role in shaping the juri

Presumptive Taxation Scheme for Business Section 44AD of Income Tax Act

A brief overview of the provisions, benefits, and limitations of the scheme for small taxpayers Introduction The Income Tax Act, India, has provisions to simplify taxation for smal

Cancellation and Suspension of GST Registration: Legal Framework and Judicial Perspectives

Introduction The Goods and Services Tax regime, introduced in India on July 1, 2017, revolutionized the country’s indirect taxation system by subsuming multiple taxes under a

Dispute Resolution Panel under Section 144C of the Income Tax Act

Introduction As previously discussed, Section 144B outlines the procedure for faceless assessment, Section 144C deals with the Dispute Resolution Panel. Together, they provide a co

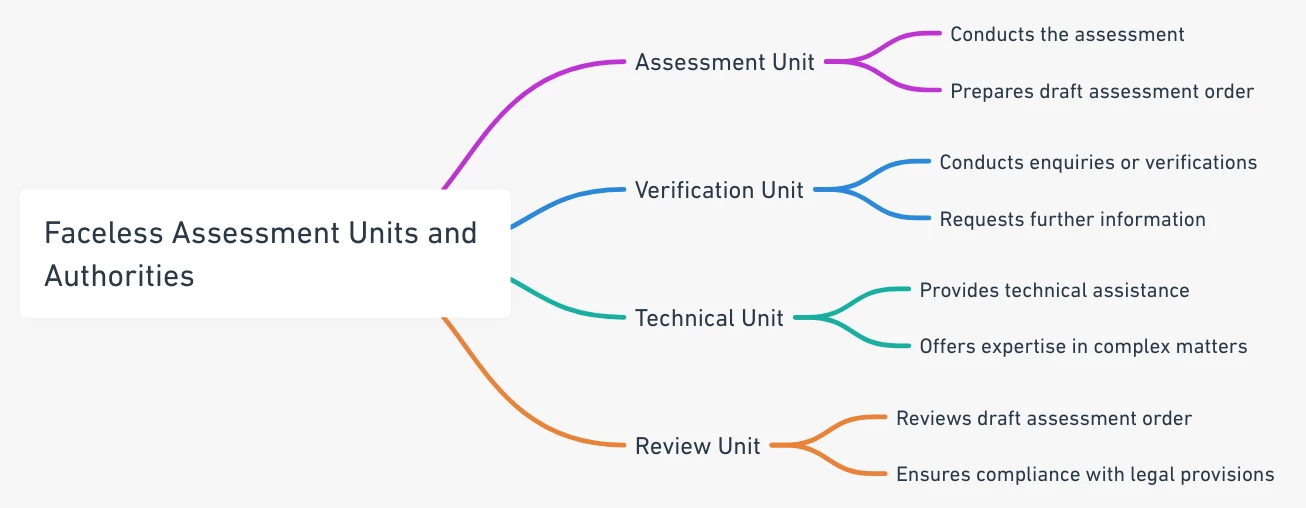

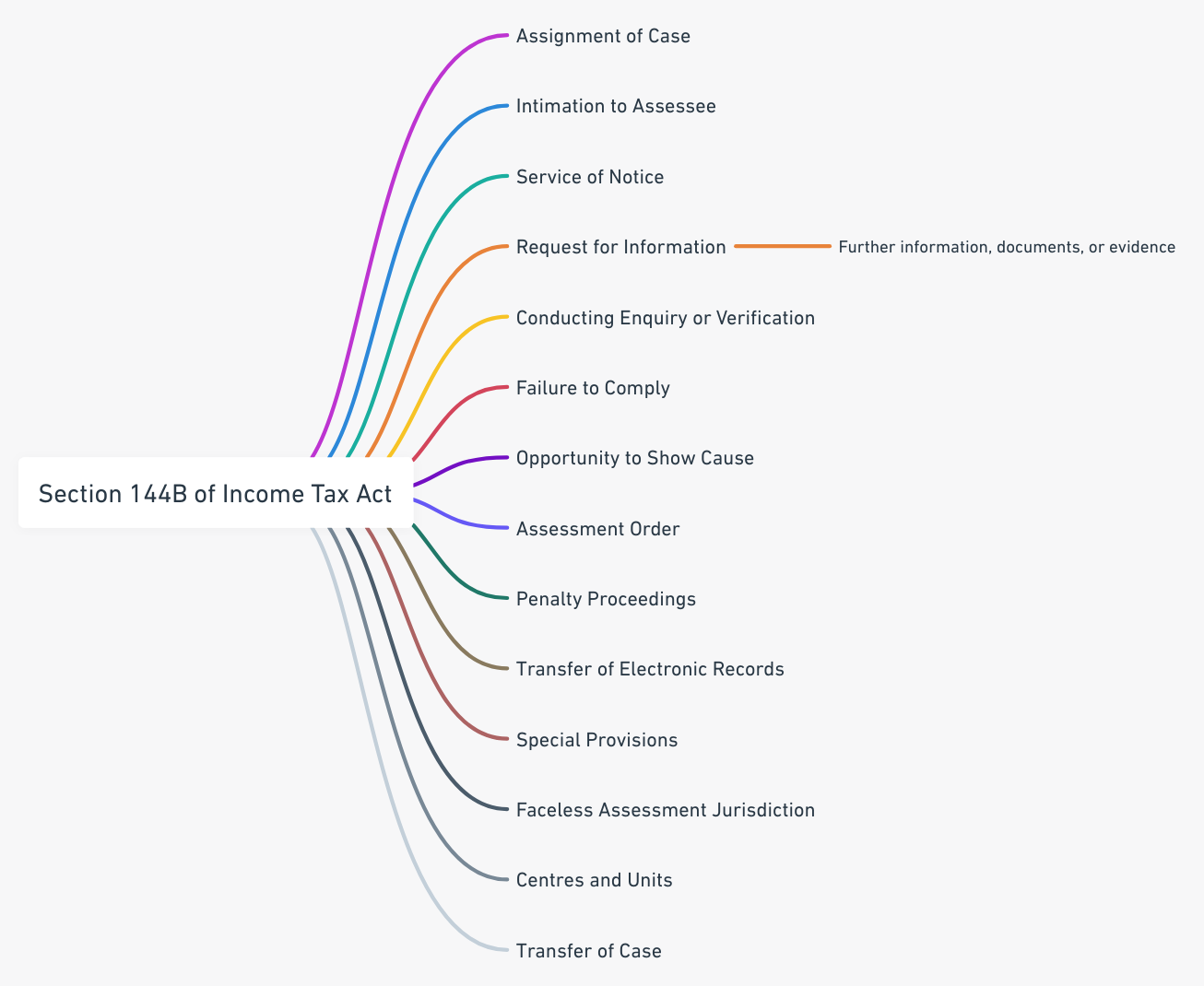

Faceless Assessment Procedure under Section 144B of Income Tax Act: Legal Framework and Operational Units

Introduction The introduction of Section 144B in the Income Tax Act, 1961, through the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020, represent

Faceless Assessment Procedure under Section 144B of Income Tax Act- Part 4

Introduction We have discussed the Introduction to Faceless Assessment, Part 1 of the series discussed provisions related to assignment and communication, Part 2 talked about enqui

Faceless Assessment Procedure under Section 144B of Income Tax Act – Part 3

Introduction Until now, we have discussed the Introduction of Faceless Assessment, assignment of cases and communication of response in Part 1, & request for information and do

Faceless Assessment Procedure under Section 144B of Income Tax Act – Part 2

Introduction We have delved into the Introduction to Faceless Assessment Procedure under Section 144B, exploring provisions related to automated allocation of cases, intimation a

Faceless Assessment under Section 144B of Income Tax Act: A Comprehensive Legal Framework and Implementation Analysis

Introduction The Indian taxation landscape witnessed a revolutionary transformation with the introduction of the Faceless Assessment Scheme under Section 144B of the Income Tax Act

Introduction to Faceless Assessment

Introduction Faceless Assessment represents a significant shift in the way tax assessments are conducted. It aims to eliminate human interaction in the assessment proceedings, ther

Whatsapp

Whatsapp