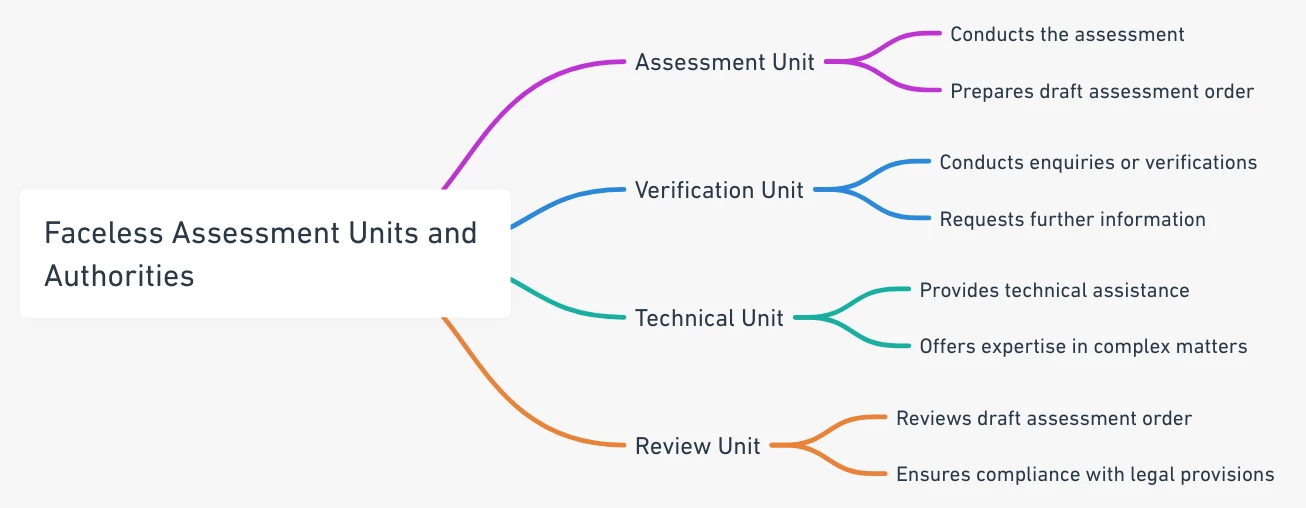

Faceless Assessment Procedure under Section 144B of Income Tax Act: Legal Framework and Operational Units

Introduction The introduction of Section 144B in the Income Tax Act, 1961, through the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020, represent

Process for Revocation of Cancellation of GST No as per Gujarat GST Act,2017

Revocation of Cancellation of GST Registration In the realm of GST regulations, the process of Revocation of Cancellation of GST registration plays a pivotal role in safeguarding t

Unjust Cancellation of GST Registration: A Case Study of GST Registration

Background This Case revolves around the issue of unjust cancellation of GST registration. The petitioner, Apparent Marketing Private Limited, was granted registration under the

Entertaining Writ Petitions When Alternative Remedy is Available and a Pure Question of Law: A Case Study

Background This article is an analysis of judgement passed by Hon’ble Apex Court dated. 01.02.2023, where the important question of law was entertaining Writ Petitions whe

The Role and Powers of the Assessing Officer in the Light of the National Company Law Tribunal’s Decision

Introduction This is a comprehensive analysis of the case involving Gayatri Projects Ltd. and the Principal Chief Commissioner of Income-tax, Hyderabad. In the realm of taxation an

Constitution of Committee of Creditor

Introduction: A creditors’ committee is a group of people who represent a company’s creditors in a bankruptcy proceeding. As such, a creditors’ committee has

Income Tax Informants Rewards Scheme 2018 and Evasion Petition Procedure

Introduction The Income Tax Informants Rewards Scheme 2018 represents a significant enhancement in India’s approach towards combating tax evasion through citizen participatio

INCOME FROM HOUSE PROPERTY

Introduction: Earnings from capital asset refers to any income earned from a house property, either in the form of rent or through its sale. The Income Tax Act treats any property,

TAX SYSTEM IN INDIA

The tax structure comprises the federal government, state governments, and municipal governments. In India, taxes are classified into two parts: direct and indirect taxes. Direct t

Cryptocurrency- brief overview of regulation.

Cryptocurrencies have gained a lot of traction in recent times in India which is home to one of the largest markets for cryptocurrencies in the world. According to a report, the co

Whatsapp

Whatsapp