GST Compliance Reforms: Analyzing the 56th GST Council Meeting Outcomes

Introduction The 56th meeting of the GST Council, convened on September 3, 2025, under the chairpersonship of Union Finance Minister Nirmala Sitharaman, marked a transformative mil

Arrest Power Under GST and Customs Act: Analysis of Radhika Agarwal Judgement

Supreme Court Limits “Power of Arrest” Under GST and Customs Acts: Analysis of Radhika Agarwal v. Union of India Introduction The landmark judgment of Radhika Agarwal v

Dispute Resolution Panel under Section 144C of the Income Tax Act

Introduction As previously discussed, Section 144B outlines the procedure for faceless assessment, Section 144C deals with the Dispute Resolution Panel. Together, they provide a co

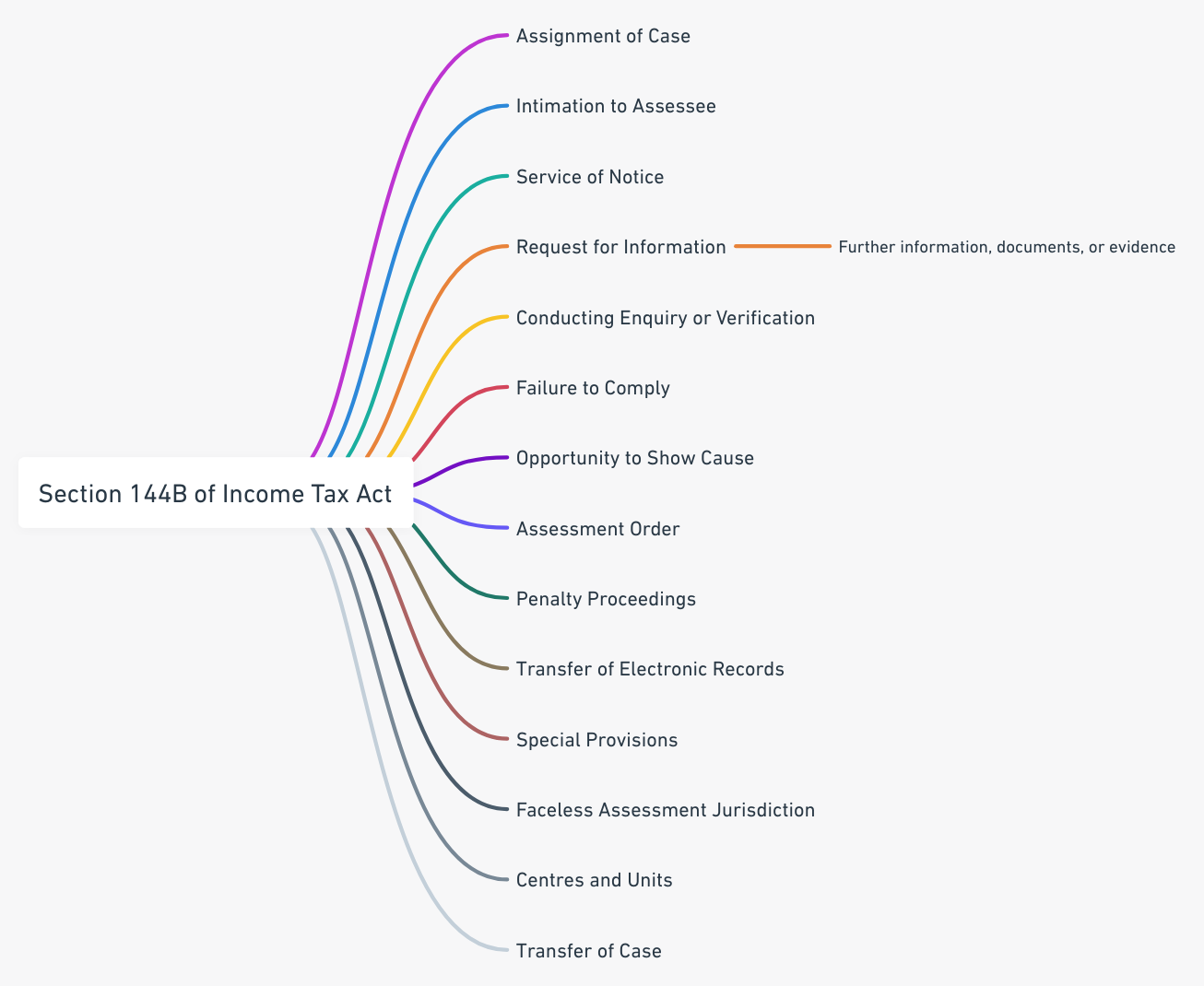

Faceless Assessment Procedure under Section 144B of Income Tax Act- Part 4

Introduction We have discussed the Introduction to Faceless Assessment, Part 1 of the series discussed provisions related to assignment and communication, Part 2 talked about enqui

Faceless Assessment Procedure under Section 144B of Income Tax Act – Part 3

Introduction Until now, we have discussed the Introduction of Faceless Assessment, assignment of cases and communication of response in Part 1, & request for information and do

Faceless Assessment Procedure under Section 144B of Income Tax Act – Part 2

Introduction We have delved into the Introduction to Faceless Assessment Procedure under Section 144B, exploring provisions related to automated allocation of cases, intimation a

Faceless Assessment under Section 144B of Income Tax Act: A Comprehensive Legal Framework and Implementation Analysis

Introduction The Indian taxation landscape witnessed a revolutionary transformation with the introduction of the Faceless Assessment Scheme under Section 144B of the Income Tax Act

Introduction to Faceless Assessment

Introduction Faceless Assessment represents a significant shift in the way tax assessments are conducted. It aims to eliminate human interaction in the assessment proceedings, ther

GST on Petroleum Products: Constitutional Framework, Legislative Provisions and Judicial Perspectives

Introduction The inclusion of petroleum products within the ambit of Goods and Services Tax (GST) has emerged as one of the most contentious and economically significant issues in

The Evolution of Indian Taxation: From Ancient Foundations to Modern GST Regime

Introduction The Indian taxation system represents one of the world’s oldest and most evolved fiscal frameworks, tracing its origins from ancient scriptural texts to the mode

Whatsapp

Whatsapp